For most Indians, paying income tax has never been simple. The rules kept changing, forms became longer, and the law itself turned into something only experts could fully understand. What was meant to be a straightforward system slowly became a maze. Many taxpayers felt frustrated—confused by deductions, worried about mistakes, and unsure whether they were paying the right amount.

This is why the New Income Tax Bill 2025 aka Income-Tax (No.2) Bill, 2025, recently passed by Parliament, is being called one of the most important reforms since independence. It promises to cut through the complexity and make life easier for millions of taxpayers across the country. More than just a few rule changes, this is a complete rethinking of how India’s tax system should work in the 21st century.

The old Income-Tax Act of 1961 was introduced more than sixty years ago. At that time, it was simple and manageable. But over the decades, hundreds of amendments were added. What began as a clear document turned into a bulky law with over 800 sections and 47 chapters. Even tax professionals often admitted that navigating it was difficult. For ordinary citizens, it felt almost impossible. Filing returns became a stressful task, and many people ended up depending completely on consultants or agents.

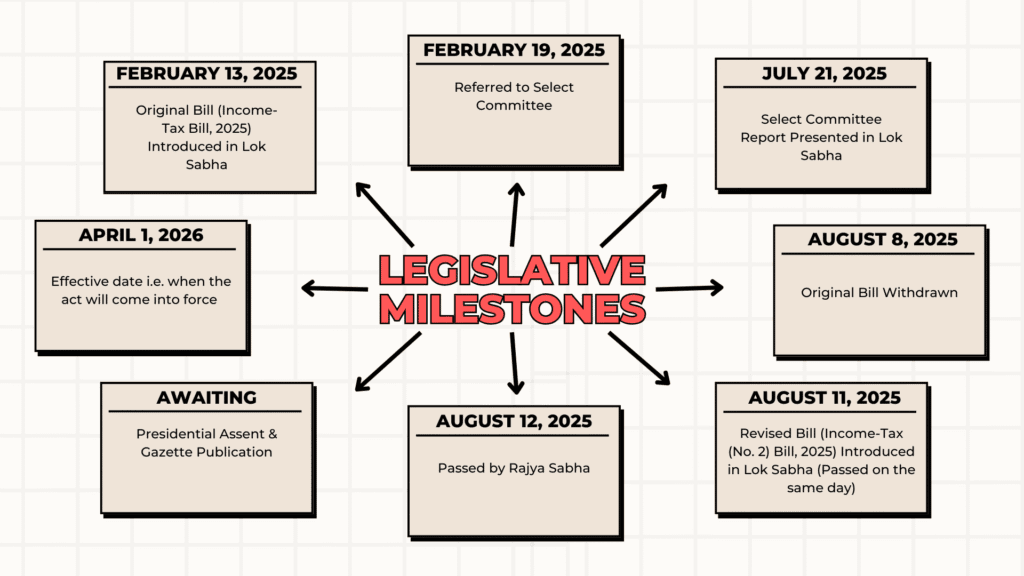

The new bill, passed on August 12, 2025, is meant to change that story. It lays out a fresh framework that will come into effect from April 1, 2026. The focus is on simplicity, fairness, and relief. Salaried employees, pensioners, property owners, small businesses, and even ordinary families will feel the difference. For the first time in decades, the system has been redesigned not just to collect taxes, but also to give taxpayers clarity and confidence.

This reform is not only about saving money—it is also about reducing stress, cutting down paperwork, and restoring trust in the tax system. With this step, India moves closer to a system where citizens don’t feel lost or pressured, but instead feel that paying tax is straightforward and fair.

The Journey to Reform

The road to this landmark legislation began with a collective realization: India’s tax system was no longer serving its people—it was, in fact, holding them back. The issue was brilliantly summed up by former Chief Justice DY Chandrachud, who remarked that 99.99% of Indians cannot understand the legal English used in tax laws. This simple truth revealed a deep flaw. Citizens weren’t avoiding taxes out of reluctance; they were struggling because the system was written in a language they could not follow. In other words, the obstacle wasn’t willingness, but comprehension.

The first draft of the Income-Tax Bill was presented in February 2025. However, instead of rushing it through, the government sent it to a Parliamentary Select Committee for scrutiny. What followed was one of the most collaborative exercises in lawmaking in recent times. The committee received over 250 recommendations from tax experts, industry groups, and civil society organizations. Instead of patchwork fixes, the government took a bold step: it withdrew the original draft and returned with an entirely revised version that absorbed these insights. This wasn’t about bureaucratic box-ticking; it was about putting taxpayers first and ensuring the law truly served the public.

Finance Minister Nirmala Sitharaman explained it best: the new law is “leaner and more focused, designed to make it easy to read, understand, and implement.” And this is not just a statement—it’s backed by hard numbers. The earlier Income-Tax Act had 819 sections across 47 chapters; the new bill trims this to 536 sections within 23 chapters. Even more striking, the overall word count has been cut by nearly half—a simplification of historic proportions in Indian legislative history.

Understanding the Magnitude of Change

To grasp how transformative this is, one must look back at the old Income Tax Act of 1961, which had been amended more than 4,000 times over the decades. Each amendment layered new complexities, contradictions, and ambiguities onto an already dense structure. The result? An endless cycle of disputes, with tax litigation turning into a cottage industry. Even minor cases dragged on for years, draining both taxpayers and revenue authorities of time and resources, while creating uncertainty across the system.

The new bill, however, does more than just cut down sections or words—it reimagines the structure of tax law itself. Outdated and confusing legal phrases such as “notwithstanding anything contained herein” or “as may be prescribed” have been replaced by simple and clear alternatives like “irrespective of” and “prescribed.” This shift toward plain English is not cosmetic—it makes the law readable for any educated taxpayer without needing specialized legal expertise.

Among the most important innovations is the introduction of a unified “Tax Year” system. Previously, taxpayers had to juggle between the “Previous Year” (when income was earned) and the “Assessment Year” (when it was taxed). This outdated two-year framework caused unnecessary confusion and delay, especially in a digital era where real-time data is the norm. The new law eliminates this gap by aligning income earning and assessment within the same year. This not only simplifies compliance for millions but also aligns India with international best practices, removing a long-standing source of taxpayer frustration.

Game-Changing Benefits for Salaried Employees

Salaried individuals emerge as the biggest winners under the new tax regime, as changes are set to put thousands of rupees back into their pockets every year. The standard deduction, which requires no proof or paperwork, has been raised from ₹50,000 to ₹75,000. This automatic ₹25,000 increase brings instant relief to every salaried taxpayer who chooses the simplified structure.

The impact grows further with the expansion of the Section 87A rebate. Earlier, only those with income up to ₹7 lakh could avail relief of up to ₹25,000. Now, the rebate applies to incomes up to ₹12 lakh annually, offering relief of as much as ₹60,000. When combined with the enhanced deduction, salaried individuals effectively enjoy a tax-free threshold of ₹12.75 lakh under the new system.

Consider this example: a software engineer earning ₹10 lakh a year paid nearly ₹30,000 in taxes under the old regime. With the new changes, their tax liability drops to zero—an outright 100% tax saving. Even those with higher incomes gain substantially. For instance, a manager earning ₹15 lakh will save around ₹35,000 annually—money that can go into investments, savings, or lifestyle needs.

This comes as a boost for India’s middle class, the engine of economic growth, which often felt burdened by rising expenses and limited tax relief. According to estimates, over 4 crore salaried taxpayers—nearly 70% of all tax filers—will benefit directly. The psychological impact is equally important: millions will see their tax outgo slashed to zero or significantly reduced, building a more positive trust in the tax system.

Property Owners Receive Long-Awaited Clarity

For real estate investors and homeowners, the new bill brings relief and much-needed clarity. The 30% standard deduction on rental income will now be explicitly calculated after deducting municipal taxes. This removes confusion that might have otherwise led to disputes, litigation, and increased tax liability for property owners.

This clarity is crucial for India’s vast rental market, where millions of homes are rented across cities and towns. Any adverse change could have affected property valuations, rental yields, and overall investment in housing. By retaining the favorable interpretation, the government safeguards the attractiveness of real estate as a long-term asset class while giving peace of mind to property holders.

Another vital step is the restoration of pre-construction interest deductions for both self-occupied and rental properties. Earlier drafts had restricted this benefit only to self-occupied homes, creating unfair treatment for investors buying under-construction properties to rent out later. The final bill corrects this, ensuring all homebuyers and investors are treated equally.

For those taking home loans, this means interest paid during construction will remain eligible for tax benefits—even if the property is later rented out. This measure supports government housing goals while also keeping real estate investment attractive, a sector that plays a central role in employment and economic growth.

Digital-First Tax Administration

The new tax bill also ushers in a digital revolution in administration. Assessments and appeals will now happen through faceless, online systems—completely eliminating physical meetings between taxpayers and officials. This addresses long-standing issues of corruption, harassment, and arbitrary treatment in the old system.

However, the bill also grants wider digital access to authorities during investigations. Tax officers can now enter virtual digital space, including email servers, social media, trading accounts, and online investment platforms, even by bypassing access codes. While this raises serious privacy concerns, the government has assured that clear Standard Operating Procedures will be issued to prevent misuse and protect taxpayer rights.

This shift reflects India’s larger journey toward a data-driven economy. The unified Tax Year framework allows integration of information from employers, banks, investment apps, and other financial platforms. As a result, compliance verification becomes faster and easier, with fewer documents demanded from honest taxpayers.

The system also uses advanced analytics to go beyond mere data checks. It can detect suspicious patterns pointing to evasion, while also identifying genuine compliance gaps that may require support instead of punishment. By combining enforcement with taxpayer-friendly service, the new regime represents a mature and forward-looking evolution of India’s tax system.

Procedural Improvements That Matter Daily

Beyond the headline tax cuts, the bill brings in procedural changes that will ease day-to-day hassles for both taxpayers and professionals. For instance, the time limit for filing TDS correction statements has been sharply reduced from six years to just two years. This means quicker resolution of TDS mismatches, an issue that troubles millions of employees and pensioners every year.

Equally important is the new flexibility on tax refunds. Earlier, anyone who missed the filing deadline—due to emergencies, health issues, or even oversight—lost the right to claim refunds, no matter how big the amount. The new rules now allow refunds even for belated returns, bringing in fairness and recognizing that real-life situations can sometimes prevent timely compliance.

For businesses and professionals, several TDS thresholds have been raised, cutting down on unnecessary compliance. The TDS limit on rent goes up from ₹2.4 lakh to ₹6 lakh annually, pulling countless small-scale rental transactions out of the TDS net. Similarly, mandatory electronic payment rules now apply only to professionals earning more than ₹50 crore a year—ensuring that the heavy compliance burden falls only on truly large enterprises.

Another big step is the extension of the timeline for filing updated returns. Taxpayers now have four years instead of two to correct mistakes or disclose missed income. This encourages voluntary compliance, acknowledging that tax matters can be complex and should not always be punished with rigid deadlines.

Special Provisions for Vulnerable Groups

The bill shows sensitivity toward groups that previously faced unfair treatment. Non-employee pensioners can now claim full deductions on commuted pensions from approved funds. This ensures that retirement benefits are taxed fairly, regardless of whether they come from a traditional employer or other arrangements. Millions of retirees stand to gain from this equitable treatment.

Charitable organizations also receive relief. The bill clarifies that anonymous donations remain exempt up to 5% of total donations or ₹1 lakh, whichever is higher. The initial draft had threatened to reduce this benefit, but after strong feedback, the favorable provision was retained. This ensures that non-profit organizations and religious trusts remain financially stable and can continue their vital social work.

Economic Impact and Growth Implications

The bill’s effects go far beyond individual taxpayers—it has a direct bearing on India’s economic growth. By leaving more money with middle-income earners, the government essentially delivers a consumption stimulus without increasing its own spending. A typical middle-class family could save ₹35,000–40,000 annually, money likely to be spent on education, healthcare, services, and daily needs.

This additional spending creates a multiplier effect across the economy, boosting demand for small businesses, service providers, and manufacturers. Since domestic consumption is central to India’s target of becoming a $5 trillion economy, the bill strengthens the foundation for long-term growth.

The simplification also lowers compliance costs for companies. Instead of spending heavily on tax experts, record-keeping, and disputes, businesses can now redirect resources toward innovation, marketing, expansion, and job creation.

For global investors, a clearer and simpler tax framework makes India a far more attractive destination. Earlier, complex tax laws were often cited as a hurdle to the ease of doing business. The new bill aligns India with international practices, making it easier for multinationals to operate and invest in the country.

Implementation Challenges and Solutions

While the new bill brings undeniable advantages, rolling out such a comprehensive reform will not be without hurdles. Transitioning away from a 60-year-old system means overhauling software, retraining staff, and educating taxpayers. To ease this process, the government has provided an 18-month transition period between the bill’s passage and its effective date—enough time for institutions and individuals to adapt.

Tax software vendors, corporate tax teams, and accounting firms will need to reconfigure systems and procedures. Even the shift from “Assessment Year” to “Tax Year” requires changes across thousands of applications, forms, and compliance processes. Though disruptive in the short term, these adjustments are seen as the necessary price for the long-term benefits of simplification.

Another delicate area is the expanded digital access powers given to tax authorities. Balancing enforcement with taxpayer privacy will be key. The government’s plan to issue detailed Standard Operating Procedures shows awareness of these concerns, but implementation will be closely scrutinized by taxpayers, privacy advocates, and even the courts.

Training tax officials also emerges as a critical factor. The faceless assessment model demands new skills compared to traditional face-to-face systems. Success here will depend on strong training programs and a robust technology infrastructure capable of supporting seamless digital interactions.

Looking Toward the Future

The New Income Tax Bill 2025 is not just about immediate relief—it prepares India’s tax framework for the next phase of economic growth. As India advances toward its $5 trillion economy goal, with greater digitalization at every level, a modern and efficient tax system becomes a necessity. By prioritizing simplification, technology, and taxpayer service, the bill lays the foundation for long-term stability and growth.

The reform also signals a shift in mindset. India is moving from being a developing economy primarily focused on tax collection to a mature democracy that balances revenue needs with taxpayer rights. This evolution—from enforcement-driven to service-oriented—marks a significant change in the relationship between the state and its citizens.

For individuals, the immediate gains are clear: lower tax outgo and easier compliance. Yet the long-term benefits—fewer disputes, faster refunds, greater clarity, and improved service—may prove even more valuable. When taxpayers trust the system, voluntary compliance rises, creating a cycle where both the government and citizens benefit.

As India gears up for this transformation, taxpayers should begin familiarizing themselves with the changes, especially the choice between the old and new tax regimes for maximum savings. Although the bill still awaits Presidential assent, its framework is already visible: a simpler, fairer, and more efficient tax structure that respects both the country’s revenue requirements and the rights of its citizens.

💰 A fair tax system begins with awareness. Stay informed. Stay confident.

📢 Share this piece to help others understand how the new bill impacts everyday taxpayers.

🌐 Explore more clear and thoughtful insights at thinkingthorough.com

💬 Your voice matters—join the conversation and shape how we view India’s economic future, together.

References

Das, N. (2025, August 13). Income tax bill 2025 changes: Commuted pension, house property income, nil TDS, and other changes, you should. The Economic Times. https://economictimes.indiatimes.com/wealth/tax/commuted-pension-house-property-income-nil-tds-and-other-changes-made-in-the-income-tax-bill-2025/articleshow/123280318.cms

Magazine, A. (2025, August 14). New Income Tax Bill 2025 passed in Parliament: key features, what changes. The Indian Express. https://indianexpress.com/article/explained/explained-economics/new-income-tax-bill-passed-in-parliament-key-features-10186767/

Taxmann. (2025, August 12). Lok Sabha passes Income-tax (No. 2) Bill, 2025. Taxmann Blog. https://www.taxmann.com/post/blog/lok-sabha-passes-income-tax-no-2-bill-2025

The Income-Tax (No.2) Bill, 2025. (n.d.). PRS Legislative Research. https://prsindia.org/billtrack/the-income-tax-no2-bill-2025

TOI Business Desk. (2025, August 12). New Income Tax Bill 2025 passed by Lok Sabha: What are the top Parliamentary panel suggestions being included? Check details. The Times of India. https://timesofindia.indiatimes.com/business/india-business/new-income-tax-bill-2025-introduced-in-parliament-what-are-the-top-parliamentary-panel-suggestions-being-included-check-details/articleshow/123232971.cms

Frequently Asked Questions (FAQs) about the New Income Tax Bill 2025

2. What is the new income tax bill in 2025?

It is the Income-Tax (No. 2) Bill, 2025, introduced in the Lok Sabha on August 11, 2025, after withdrawal of the original bill.

3. Is 7 lakh income tax free?

Yes, under the existing regime, income up to Rs. 7 lakh is effectively tax-free with rebates under Section 87A, and this may continue in the new bill.

4. What is the new rule of income tax?

The new rules will apply from April 1, 2026 (FY 2026-27 / AY 2027-28) once the bill receives Presidential assent and is notified in the Gazette.

5. Has the new tax bill passed?

Yes, it was passed in Lok Sabha (Aug 11, 2025) and Rajya Sabha (Aug 12, 2025), but it is still awaiting Presidential assent and Gazette publication.